Insights

When the Dashboard Makes the Difference

Compliance is About More Than Initial KYC

In the UK, Money Transfer Businesses (MTBs) are regulated by the Financial Conduct Authority (FCA). The aim is not just to ensure proper conduct within financial service businesses, but also to limit the extent to which businesses, and therefore the

UK MTBs: Prepare for Rising Competition

The UK’s money transfer service (MTS) industry has thrived on a mix of established financial institutions and innovative startups. Demand for their services has been high, so the marketplace has been relatively comfortable. That may be about to change. A

Wanted: Efficient and Effective Compliance for a Competitive Edge

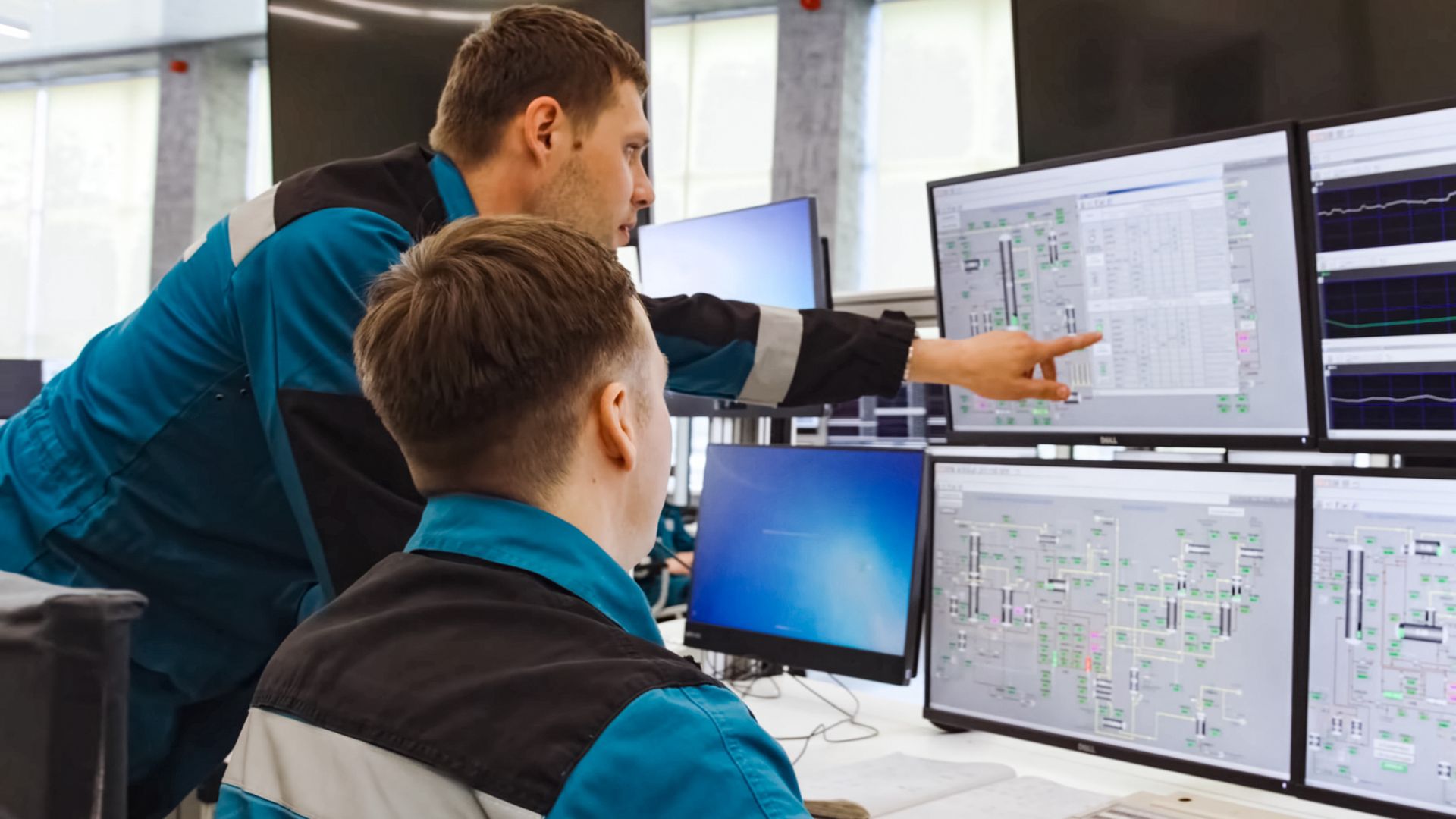

It’s an understatement to say the UK’s remittance sector is highly competitive. It’s an environment where survival can depend on achieving both efficiency and effectiveness. And nowhere is it more evident than with compliance processes. Money Transfer Businesses (MTBs) grapple

Don’t Get Left Behind: Why Scalable Compliance is Key for Remittance Providers

The financial services sector is heavily regulated, and compliance demands can be a burden for businesses of all sizes. Remittance providers, also known as money transfer businesses (MTBs), are no exception. Know Your Customer (KYC) checks, anti-money laundering (AML), counter-terrorism

The Changing Shape of the UK Remittance Market

The remittance market in the United Kingdom is undergoing gradual but significant transformation. Traditionally dominated by links with the Indian subcontinent, the focus is broadening to include several African countries as key destinations for funds. The shift reflects broader economic

In the UK Money Transfer Market, it Pays to Stay in the Know

The UK’s financial system continues to develop and grow, not least in the money transfer market. Growth is fueled by complementary factors: demand is high, and digitalization makes sending money overseas easier and cheaper than before. There are over 650

In the Remittance Service Market, it Pays to Stay Alert

In the UK remittance service market, the call for vigilance against financial crime has never been louder. The Financial Conduct Authority (FCA), the UK’s financial regulatory body, has reaffirmed its commitment to combating financial crimes, with a specific focus on

Taking the Risk out of Remittance

As digital technology has become better and cheaper, the cost of entry into the remittance, or money transfer, market has dropped. Currently, there are over 60,000 business operating in the UK remittance market. It’s competitive, but as remittance gets easier,

Offering Remittances at 0% fees? Ensure your MTB operations are seamless!

A recent announcement by money transfer business (MTB) LemFi highlights a growing trend in the UK remittance market. Along with other providers they now offer zero fees on some transfers, coupled with competitive exchange rates. LemFi’s promise is zero fees for transfers from the UK...

Do your Identity Checks Really Establish Customer IDs?

In the UK, financial services regulation is stringent. Expectations are high, within the industry, and more broadly in the economy and society too. Non-compliance can have severe consequences, including fines, reputational damage and, potentially, the loss of the right to operate. For Money Transfer Businesses...

Money Transfer Services – Why Small Details Matter

As in any other business, in the UK’s remittance sector getting the details right is fundamentally important. It’s a growing market, possibly booming. Operators who pay consistent attention to detail should succeed. Those who take shortcuts make themselves especially vulnerable. With an estimated worth of...

Compliance is About More Than Initial KYC

In the UK, Money Transfer Businesses (MTBs) are regulated by the Financial Conduct Authority (FCA). The aim is not just to ensure proper conduct within financial service businesses, but also to limit the extent to which businesses, and therefore the whole financial sector, are exposed...

UK MTBs: Prepare for Rising Competition

The UK’s money transfer service (MTS) industry has thrived on a mix of established financial institutions and innovative startups. Demand for their services has been high, so the marketplace has been relatively comfortable. That may be about to change. A growing number of new or...

Wanted: Efficient and Effective Compliance for a Competitive Edge

It’s an understatement to say the UK’s remittance sector is highly competitive. It’s an environment where survival can depend on achieving both efficiency and effectiveness. And nowhere is it more evident than with compliance processes. Money Transfer Businesses (MTBs) grapple with the dual challenges of...